Center for Financial and Economic Education

Our Mission

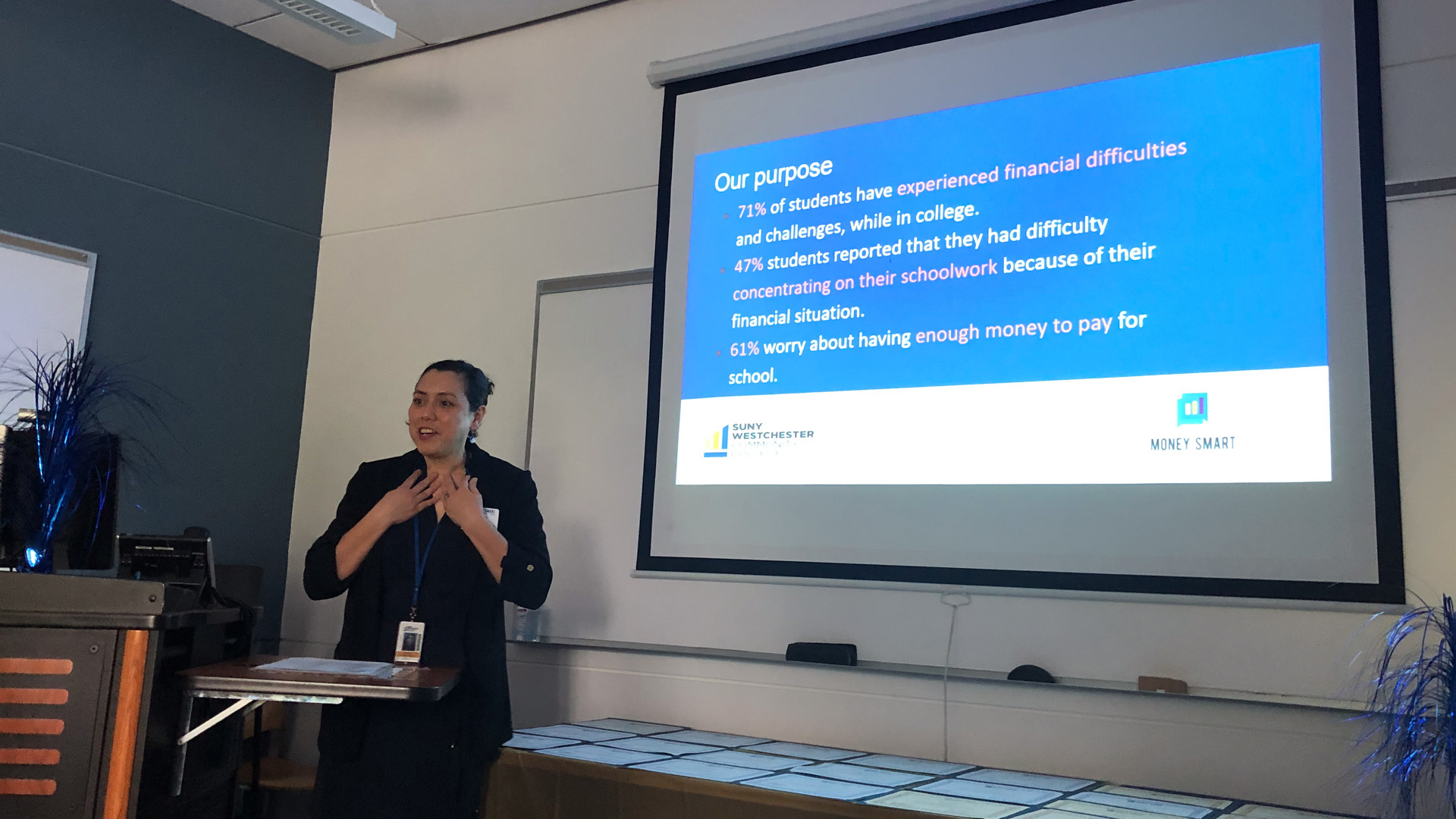

The Center for Financial and Economic Education (“CFEE”) seeks to promote economic advancement for students at Westchester Community College, through programs that build critical skills around money management and financial decision-making.

Our comprehensive platform for financial learning includes financial coaching, financial literacy, classes, workshops, and other educational resources, with the objective of fostering financial empowerment for students in our college community.

Through these CFEE initiatives, we aspire to establish best practices in financial education and to develop training methodologies for community college students. As part of our mission, the CFEE actively advocates for student financial health among community colleges, and provides a forum for exchange of ideas and thought leadership in financial and economic education.

Since our inception in 2011, the CFEE has been generously funded by JPMorgan Chase & Co. We are also grateful for important contributions from Webster Bank, N.A. and the National Endowment for Financial Education, in support of personal finance education programming for our students.

CFEE Guidebook

This Guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial literacy as a way to empower students to build money management skills and make healthy financial decisions. In the guidebook, we share lessons learned from our Money Smart Forum program and offer strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting. We also provide a step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources.

This guidebook was written to shine a light on the importance of financial capability and to underscore reasons why financial coaching supports the mission and values of community colleges. It can also be used as a resource for any institution that wishes to consider financial coaching as a way to advance student financial health.

Helpful Tips

Dear Students:

We hope you are all staying safe and healthy. As a reminder, our coaches will be maintaining financial coaching sessions, and will be reaching out to you to make an appointment. Some of you have already had meetings, but please do not hesitate to contact your coach or me, if you wish to set up a meeting by phone.

We know that this is a difficult time for many students, especially those who may have been laid off or lost a job. If you are facing financial hardship, this is a good time to reach out to your coach for help with your finances.

If you have been laid off from a job or have reduced income, here are some things to think about:

- If you have lost a job, file for unemployment benefits immediately, even if you do not think you qualify. New York State has recently ended the 7-day waiting period, so you can file a claim sooner. You can file for benefits online through the New York State Department of Labor.https://labor.ny.gov/unemploymentassistance.shtm

- If you worked for a restaurant chain or in the hospitality industry, check with your employer to see if they are offering any type of relief aid. Some companies are providing employees with food and other types of assistance.

- The government is suspending all federal student loan payments for 60 days, and setting the interest rate on student loans to zero, until at least May 12th so if you owe money on student loans, you will be getting a break. To obtain the 60-day reprieve, borrowers will have to submit a request to their loan servicers, such as Navient, Nelnet, FedLoan Servicing or Great Lakes, over the phone or online.

- The Internal Revenue Service has postponed the tax filing date from April 15 to July 15th. However, if you are expecting a refund, you do not need to wait. You should file as soon as possible in order to get your money more quickly. Please let us know if you need help filing a return.

- Keep in mind that the federal government is in the process of finalizing legislation that would send checks to taxpayers by the end of April. The amount of the payments could vary depending on income and family size, but it is reported that some of the checks could be as high as $1,200. Those who did not earn enough to pay income tax would receive a smaller amount, about $600. Details have not yet been finalized, and not every individual will benefit. We will communicate further information as soon as it becomes available.

Financial Literacy Workshops

We are delighted to offer the following workshops for the Fall 2025 Semester. Join us to learn more about important financial wellness topics that will help you manage your money smarter.

Throughout the semester we will host workshops in person and online that will cover an array of topics, including:

- Values, Financial Goas, and Goal Setting

- Budgeting and Saving

- Mobile and online Banking and Digital Financial Safety

- Understanding and Building Your Credit

- Savings and Investing

- How to Use Credit Wisely and Manage Debt

Please see the events calendar below for upcoming event details, and the link to register for an upcoming session.