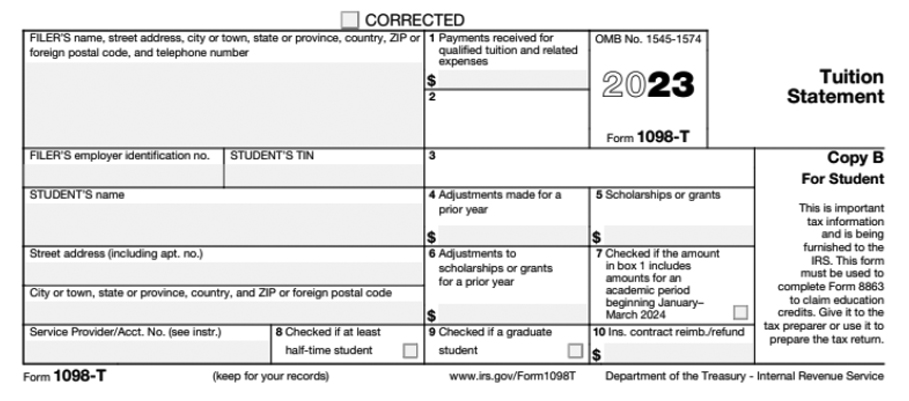

IRS 1098-T Tax Form

IRS 1098-T Tax Form for 2023

Eligible educational institutions, such as Westchester Community College, are required to submit the student’s name, address, and taxpayer’s identification number, enrollment and academic status. The IRS instructs institutions to report either payments received (Box 1) or amounts billed for qualified tuition and related expenses (Box 2) on the 1098-T. Westchester Community College reports payments received for qualified tuition and related expenses during the tax year (Box 1) and scholarships and grants (Box 5). Therefore Box 2 will be blank.

This form is informational only. It serves to alert students that they may be eligible for federal income tax education credits. It should not be considered as tax opinion or advice. There is no IRS requirement that you must claim the tuition and fees deduction or education credit. Claiming education tax benefits is a voluntary decision for those who may qualify. It is up to each taxpayer to determine eligibility for the credits and how to calculate them. Please refer any questions on how to calculate them to your accountant / financial advisor.

Accessing the 1098-T Form:

- How to View and Print Your 1098-T form

- How do I get my 1098-T Form online?It is easy. Log in through our portal at mywcc.sunywcc.edu it’s just a few mouse clicks! Once you sign in:a) Click Student Self Service Center tab

b) Scroll to Financial Account section

c) Select Account Services

d) Select View 1098t tax form

e) Choose the year - Is the access secure?Yes. Access can only be obtained by logging in through our mywcc.sunywcc.edu portal.

IRS 1098-T Form for 2023 “Instructions for Student”

An eligible educational institution, such as a college or university in which you are enrolled, and an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you must furnish this statement to you. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 or 1040A, only for the qualified tuition and related expenses that were actually paid in 2023. To see if you qualify for the credit, see Pub. 970, Tax Benefits for Education; Form 8863, Education Credits; and the Form 1040 or 1040A instructions.

Institutions may report either payments received during the calendar year in box 1 or amounts billed during the calendar year in box 2. [WCC NOTE: WCC reports amounts paid in box 1, and this is why box 2 is always blank.]

The amount shown in box 1 may represent an amount other than the amount actually paid in 2023. Your institution must include its name, address, and information contact telephone number on this statement. Although the filer or the service provider may be able to answer certain questions about the statement, do not contact the filer or the service provider for explanations of the requirements for (and how to figure) any education credit that you may claim.

Filer’s federal identification number. This number represents Westchester Community College’s Federal ID number (EIN).

Student’s identification number. For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), or adoption taxpayer identification number (ATIN). However, the issuer has reported your complete identification number to the IRS and, where applicable, to state and/or local governments.

Account number. May show an account or other unique number the filer assigned to distinguish your account.

Box 1. Shows the total payments received in 2023 from any source for qualified tuition and related expenses less any related reimbursements or refunds made during 2023 that related to those payments received during 2023.

Box 2. Shows the total amounts billed in 2023 for qualified tuition and related expenses less any related reductions in charges made during 2023 that relate to those amounts billed during 2023. [WCC NOTE: Box 2 is always blank on our Form 1098-T. See above.]

Box 3. Shows whether your institution changed its method of reporting for 2023. [WCC NOTE: WCC did not change our method of reporting.]

Box 4. Shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund). See “recapture” in the index to Pub. 970 to report a reduction in your education credit or tuition and fees deduction.

Box 5. Shows the total of all scholarships or grants administered and processed by the eligible educational institution. The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of the education credit you claim for the year.

Box 6. Shows adjustments to scholarships or grants for a prior year. This amount may affect the amount of any allowable tuition and fees deduction or education credit that you claimed for the prior year. You may have to file an amended income tax return (Form 1040X) for the prior year.

Box 7. Shows whether the amount in box 1 includes amounts for an academic period beginning January – March 2023. See Pub. 970 for how to report these amounts.

Box 8. Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution. If you are at least a half-time student for at least one academic period that begins during the year, you meet one of the requirements for the American opportunity credit. You do not have to meet the workload requirement to qualify for the lifetime learning credit.

Box 9. Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential. This box should be blank.

Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. The amount of reimbursements or refunds for the calendar year may reduce the amount of any education credit you can claim for the year (may result in an increase in tax liability for the year of the refund).

General Questions & Answers

- What is Form 1098-T?Colleges and universities are required by U.S. law each year to provide each student who is a “US citizen” for tax purposes with Form 1098-T, to assist the students and their families in computing any tax credit or deduction they may be able to claim, based on amounts they have spent for education. For 2023, these federal tax benefits include the American Opportunity Credit, the Lifetime Learning Credit, and the tuition and fees deduction.

- Will I receive Form 1098-T?WCC students whose student account had payment transactions post to it during the calendar year will have online access to their Form 1098-T or receive it in paper form in late January. You may receive Form 1098-T even if you did not attend class during the calendar year. Receiving Form 1098-T does not necessarily indicate that you are entitled to claim any of the education-related tax credits or deductions.

- What should I do with my Form 1098-T?You should immediately give it to whomever is responsible for preparing your tax returns. If you prepare your own tax returns, you should keep your Form 1098-T in a file with your other tax documents. Form 1098-T should remain in your files. You do not need to attach Form 1098-T to your tax returns.

- How can I get a copy of my Form 1098-T for a prior year?Please contact the Bursar’s Office for assistance in obtaining a prior year 1098-T Form.

- Where can I go for help in understanding my Form 1098-T?First, please review the FAQs on this page because they will answer many typical questions. For general information on Form 1098-T and the related tax credits and deductions, you may also want to review the information available from IRS in Publication 970 (Tax Benefits for Education) or elsewhere on the IRS web site.If you have questions about the specific transactions reported for your own student account at WCC, please contact our One Stop Student Service Center by e-mail at Bursar@sunywcc.edu or by phone at 914-606-6684.

- Will my parents receive a copy of Form 1098-T?We make Form 1098-T available to our students. Each student should provide their 1098-T Form to the individuals claiming them as a dependent.

- Should I expect other tax forms from WCC?WCC employees will also receive Form W-2, Wage and Tax Statement, in the mail.

- Will WCC send a copy of my Form 1098-T to the federal government or the State of New York?Like all colleges and universities, WCC is required to submit the data from your Form 1098-T to the Internal Revenue Service (IRS). The State of New York does not require us to report Form 1098-T data to them.

- What if my name, address or social security number is incorrect on the form?You will need to contact the College’s Registrar’s Office and provide proof of your address or social security number.

- What if I did not get a 1098-T Form?Students whose account were paid fully with grants, awards, or third-party payments, and did not make payment to their student account will not have a form generated and/or mailed to them.

In 2023 due to The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, students may have received one or more payments in 2023. These payments, if received, were not directly applied to tuition or fees, but were issued as check payments to the student. They are included in Scholarships or grants (Box 5) of the 1098-T form. They are labeled as HEERFII and CARES ACT in the student’s invoice.

Bursar’s Office/Payment

For all Bursar and Payment/Tuition Information:

https://www.sunywcc.edu/admissions/bursars-office/

Contact Information

75 Grasslands Road

Valhalla, NY 10595

Email: bursar@sunywcc.edu

Also: Use the Q Minder system at https://www.sunywcc.edu/admissions/bursars-office/

Hours of Operation

Monday, Tuesday, Friday: 9:00 a.m. – 4:30 p.m.

Wednesday, Thursday: 9:00 a.m. – 6:30 p.m.